What’s Your Long-Term Focus?

Hello Eagle Wealth Community,

As our financial planning series comes to end, looking back we sure covered a lot of ground. We started off with the Steps to Build a Financial Plan, then why you need a Solid Financial Foundation, and the questions we hear the most about Tax Efficiency in Retirement. After that we touched on 5 Ways to Stay Confident in Retirement, and how to stay calm in volatile markets by sticking to the 7 Principles of Long-term Investing.

We’ve talked a lot about the components of a plan but knowing what kind of life we want is just as important. And once we figure out what we want, how do we stay focused on it?

As we start to prepare for another new year (fingers crossed for a calm 2022), it can be overwhelming to think about long-term planning. And that makes sense since we’ve seen how quickly our long-term plans and goals can be turned upside down, and we’ve spent the past year or so dealing with a lot of short-term changes.

So how do we bring the long run into focus without getting derailed by the short run?

One way is by thinking of the long term as a series of short-term challenges, rather than one uninterrupted straight line.

Here are three simple strategies that can help you train your mind:

-

Create a “future-you” mindset. Who is future you? What do they want? How can you help them get there? Embracing your future self as someone who needs you will help you create a better future with smart choices now. Sound a little woo woo? It’s actually based on the concept of “future-orientation,” or embracing the idea that not only is the future unwritten but that you can write it — especially for yourself.1 And this idea can have real benefits. Studies have shown that future-orientation is a strong predictor for achievement, health, and happiness in life.2

-

Prioritize flexibility over certainty. As humans, we’re wired to look for certainty. It feels good to think we have everything figured out. Our instincts tell us to act quickly in the short-term to avoid the discomfort we feel with uncertainty. But in a complex world with complex problems, acting quickly isn’t always the best move. We often get better results in the long term by keeping a flexible mindset and experimenting with different solutions.3

-

Recognize how emotions affect our decision-making. We’ve all had times when we’ve acted in the heat of the moment. Something makes us unusually happy or upset in the short-term, and we make a snap decision that has long-term consequences.4 One way this plays out in investing is loss aversion, a cognitive bias that causes us to focus so hard on avoiding losses that we often miss out on the big picture, long-term benefits of a strategy.

Remember, you have a team to look after your financial life so you can share your worries and we’re here to help you take action — both in the short term and the long term.

Your Eagle Wealth Team

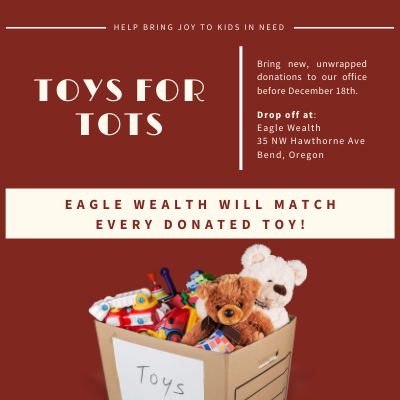

Eagle Wealth has been invited to participate in the Toys for Tots program. This national organization distributes toys to children in need during the holiday season. The box is set up in our lobby and our team can’t wait to get to work and fill it up!

We’ll match every toy donated, so please join us in the fun! Drop by our office with a (new and unwrapped) toy. We’ll collect gifts until December 18th.

Click here for more information about the program.

P.S. If you live outside of Central Oregon and who want to participate, let us know if you make a donation locally and we'll put another toy in the box.

|

|

|

|