What's Your Legacy?

Cami and I took the kids away on vacation a couple weeks ago and it got me thinking about one word: legacy. What does it mean to me? What will my legacy be with my loved ones?

The word means something different to everyone. What does it mean to you?

Legacy can feel like a heavy word as it implies what happens after you’re gone, but let’s push through that. Yes, mortality can be tough to think about, but I always encourage clients to consider the alternative: If you don’t make a plan for what will happen to your assets when you’re gone, then the government may end up doing it for you.

That process can be slow, expensive, and painful for your beneficiaries, who may not receive the amount you (or they) hoped. What’s more, going through probate court means the disposition of your estate becomes a matter of public record.

Sounds pretty unpleasant, right?

Yet that appears to be the route most people have chosen to go. According to one recent survey, 67% of U.S. adults do not have a living will or trust.

So my question for you this week is this: What do you want your legacy to look like?

Legacy planning looks different for everyone. You can focus on one thing, or accomplish several goals:

- Some people look for the best ways to pass on wealth to loved ones

- Some focus on more intimate details, like the distribution of heirlooms among family members

- Still others use it to contribute to a cause they care about, their local church, or university

One step in setting up your legacy is to get to work on an estate plan. Building a complete estate plan not only allows you to direct where your assets will go, it can also help minimize the tax burden on your loved ones, ensuring you’re able to leave the biggest legacy possible.

That being said, building a complete estate plan is a rather large task – wills, trusts, who will be responsible for the decisions, beneficiaries, account transfers. Sitting here updating my own estate plan, I know how many details there are. Getting it all down on paper can be daunting.

If you’re reading this as an Eagle Wealth client and you want to discuss your estate plan, hit “reply” or give us a call. We’d be happy to talk over where you are and what you should consider. If you’re not a client and want to talk about your estate plan, we’d love to hear from you, too! We’ll do our best to help.

Until next week,

Your Eagle Wealth Team

5-Minute Core-Strengthening Workout

Even if you only have a little time to dedicate to a core workout, this circuit will get you going and only takes 5 minutes. Here are the moves:

- 1-minute high plank: Your hands are on the ground, your arms are straight, and you are holding your body up with your arms and a tight core.

- 30-second side plank on each side: One hand is on the ground, your arm is straight, and the other is in the air. You can do a side plank with your feet stacked on each other (most demanding), your feet staggered (a little easier), or your bottom knee on the ground.

- 1-minute boat poses: Your feet are in the air, and your arms are by your side, reaching to your feet. You can pose with your legs bent (easier) or straight out (harder).

- 1-minute crunches: Lift your shoulders and upper back off the ground without pulling your neck.

- 1-minute dead bug: Lay on your back and alternate, extending out the opposite arm and the opposite leg simultaneously.

Tip adapted from Mind Body Green Movement7

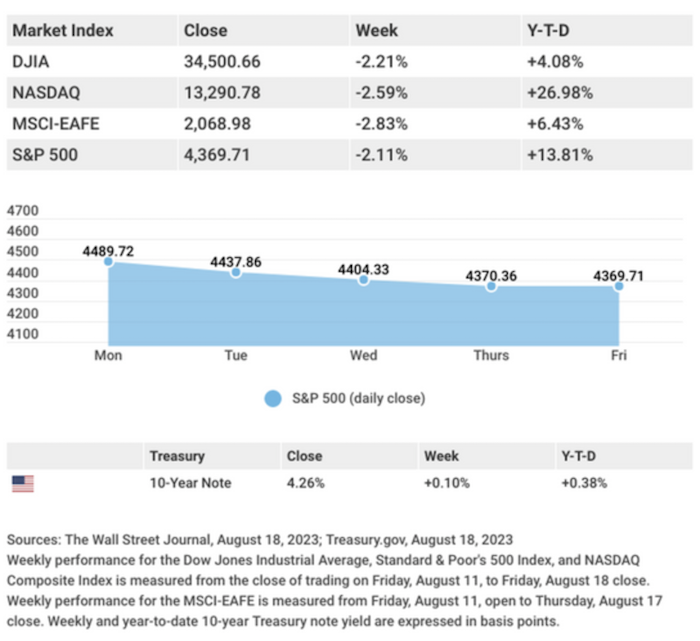

The Week on Wall Street

Stocks extended their August declines last week as higher yields and weak economic data out of China soured investor sentiment.

The Dow Jones Industrial Average lost 2.21%, while the Standard & Poor’s 500 retreated 2.11%. The Nasdaq Composite index backtracked 2.59% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slumped 2.83%.1,2,3

Stocks Wilt

Rising bond yields, driven primarily by strong economic data and the release of the minutes from July’s Federal Open Market Committee (FOMC) meeting that pointed toward Fed officials’ potential need to raise rates further, weighed on stocks throughout the week.

In a week of light trading typical of August, stocks were additionally buffeted by a string of economic data that painted a flailing economic recovery in China and warnings of potential downgrades of dozens of U.S. banks by Fitch, a credit-rating agency.

After the 10-year Treasury yield rose to its highest level since October 2022 on Thursday, yields eased on Friday, helping to arrest the week’s downward trend.4

Retail Sales Surprise

Retail sales jumped 0.7% in July, the fourth-consecutive month of increasing consumer spending on goods. The report supported the growing narrative that the U.S. may be able to avoid a recession in the near term. The strong spending data, supported by a robust labor market, also may have placed the Fed in a more difficult position in trying to bring inflation down to its target rate without more rate hikes.5

Consumer spending was higher in most categories, including bars and restaurants, grocery and hardware stores, and back-to-school items like books and clothing. Sales of autos and electronics fell, a possible consequence of higher borrowing costs.6

Any companies mentioned are for informational purposes only, and this should not be considered a solicitation for the purchase or sale of their securities. Any investment should be consistent with your objectives, time frame, and risk tolerance

Advisory Services offered through My Legacy Advisors, LLC dba Eagle Wealth Management, a registered investment advisor. Confidential Information: This message and any attachments contain information from Eagle Wealth Management, which may be confidential and/or privileged and is intended for use only by the addressee(s) named on this transmission. If you are not the intended recipient, or the employee or agent responsible for delivering the message to the intended recipient, you are notified that any review, copying, distribution or use of this transmission is strictly prohibited. If you have received this transmission in error, please (i) notify the sender immediately by e-mail or by telephone and (ii) destroy all copies of this message.

1. The Wall Street Journal, August 18, 2023

2. The Wall Street Journal, August 18, 2023

3. The Wall Street Journal, August 18, 2023

4. CNBC, August 18, 2023

5. The Wall Street Journal, August 15, 2023

6. The Wall Street Journal, August 15, 2023

7. Mind Body Green Movement, April 24, 2023

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2023 FMG Suite.