Volatility Continues

The Week on Wall Street

Markets remained exceptionally volatile, buffeted by the spreading impact of coronavirus, uncertain responses from federal policymakers, and the sudden drop in oil prices.

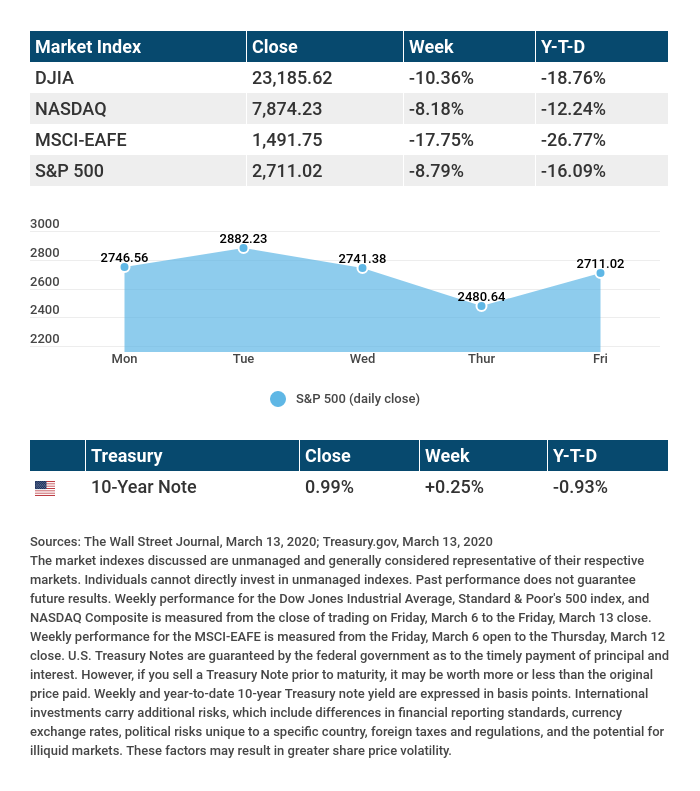

The Dow Jones Industrial Average fell 10.36%, while the S&P 500 declined 8.79%. The Nasdaq Composite index slid 8.18% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, dropped 17.75%.[i],[ii]

Markets Grapple with Uncertainty

A dispute between Saudi Arabia and Russia over oil production cuts, mounting fears of the coronavirus, the declaration of the COVID-19 as a global pandemic by the World Health Organization, and the news of a travel ban from Europe unsettled markets throughout the week.

Stock trading was halted twice by circuit breakers, which are designed to briefly stop trading when losses in the S&P 500 reach 7%. Stocks sold off sharply Thursday before ending a tumultuous week with a strong rebound on Friday.[iii]

Troubles in the Oil Patch

The failure of Russia to join Saudi Arabia in supporting lower oil production targets left Saudi Arabia fuming. In response, Saudi Arabia announced its intention to raise oil output.

Oil prices plummeted on the news, contributing to the stock market’s drop on Monday. While lower oil prices may represent a boon to consumers in the form of lower gasoline prices and relief to companies with high energy consumption (e.g., airlines, chemical), they also pose a risk to the American energy industry. If low oil prices persist, it may lead to lower capital expenditures and potential issues in the credit markets, as less-well-capitalized companies struggle to manage their debt obligations.[iv]

Final Thought

The world’s central bankers have already taken several steps to combat the economic impact of the coronavirus, including lowering short-term interest rates. The financial markets are now looking for a response from the U.S. government. In evaluating any actions from the federal government, investors may focus on the size and timing of policy proposals to determine if they can reduce current levels of economic uncertainty.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Retail Sales, JOLTS Report (Job Openings and Labor Turnover Survey), Industrial Production

Wednesday: Housing Starts, FOMC (Federal Open Market Committee) Announcement

Thursday: Leading Economic Indicators

Friday: Existing Home Sales

Source: Econoday, March 13, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Coupa Software (Coup)

Tuesday: FedEx Corp. (FDX), MongoDB (MDB)

Wednesday: General Mills (GIS), Ctrip.com (TCOM)

Thursday: Tencent Holdings (TCEHY), Lennar (LEN)

Friday: Tiffany & Co. (TIF), BMW (BAMXF)

Source: Zacks, March 13, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.