The Virus Becomes the Focus

The Week on Wall Street

Stocks fell sharply last week as Wall Street considered how the coronavirus outbreak might influence global business activity and household spending.

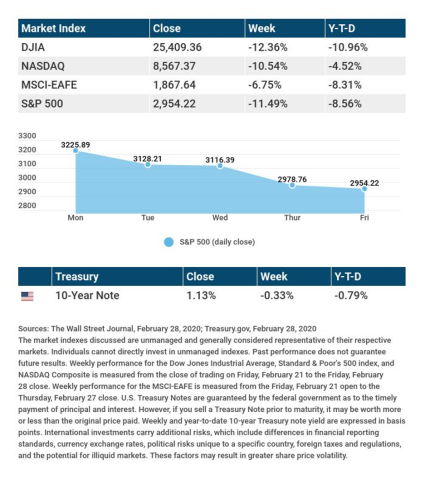

The selloff became a correction for the U.S. markets. The S&P 500 retreated 11.49%; the Dow Jones Industrial Average, 12.36%; the Nasdaq Composite, 10.54%. The MSCI EAFE, tracking developed stock markets outside North America, had fallen 6.75% week-over-week by Friday’s closing bell.

On Friday afternoon, Federal Reserve Chair Jerome Powell stated that central bank officials were willing to “use our tools and act as appropriate to support the economy.”[i],[ii],[iii]

Strong Consumer Confidence, Plus a Boost for Incomes

A trio of economic indicators pertaining to U.S. households looked solid last week. The Conference Board’s Consumer Confidence Index notched consecutive months above 130 for the first time since July-August 2019, posting a 130.7 February mark. The University of Michigan’s final February Consumer Sentiment Index came in at 101.0, ticking up from a preliminary 100.9.

Friday, the Department of Commerce reported that Americans increased their personal spending by 0.2% in January, while personal incomes improved 0.6%.[iv],[v]

Buyers Have Flocked to New Homes

New home sales, according to the Census Bureau, improved 7.9% in January; the annualized pace of new home buying was the best seen since July 2007. Year-over-year, sales were up 18.6%. Housing market analysts cited a favorable economy and favorable weather as factors.[vi]

Final Thought

Right now, there is no forecast for how the coronavirus outbreak may affect consumer demand or supply chains. The impact may not be known for months. But remember, your investment strategy should reflect your risk tolerance, time horizon, and goals, and it also should take into consideration periods of market volatility. Fear is driving decisions in the financial markets. Nobody would blame you if this uncertainty gave you a bit of anxiety as well.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: The Institute for Supply Management’s latest factory activity index arrives.

Wednesday: Automatic Data Processing (ADP) publishes its February private payrolls report, and ISM’s index of February service-sector business activity appears.

Friday: The Department of Labor presents its February employment report.

Source: MarketWatch, February 28, 2020

The MarketWatch economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: AutoZone (AZO), Ross Stores (ROST), Target (TGT)

Thursday: Costco (COST), Kroger (KR)

Source: Zacks, February 28, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.