U.S. Economy Gains Momentum

School may be out for summer but it's not too late to honor our educators. The next recipient of the Invested in Community program has gone above to help some of our littlest community members succeed in school.

Ms. Boni is our granddaughter's first grade Spanish Immersion teacher. We saw first hand how exceptionally well she handled the challenge of teaching via online classes. Somehow she managed to create a "room" of laughter and learning with her students daily via Webex. The packets she created for pickup had engaging activities and she utilized a lot of online resources to help the students continue learning. And she did all this from home with 4 young boys also at home. We can imagine how difficult working from home must have been for her! In addition to supporting a local business, we expect she and her boys will enjoy an unexpected reward shopping at Leapin' Lizards Toy Comapny.

We appreciate the opportunity to recognize a teacher--another "front line" community member making a positive difference.

Didn’t get a chance to enter? It’s not too late. The next drawing is on June 24th so enter now. And by the way, we didn’t hear from anyone outside Oregon so we’d like to clarify— wherever you live, you are eligible to take part!

*No need to enter a second time. Your original entry will roll-over from month to month.

We're inching towards the summer season and its already nearly Independence Day. Just like all good things, it'll be over before you know it. That's why the team here at Eagle Wealth decided to get the most out our time by making a summer bucket list. We're rounded up our favorite summer activities and are determined to make the best out of the season.

Get outside

"Summit South Sister, Broken Top, and Three Fingered Jack" - Brody

"Find the time to do an overnight kayak trip down the Pemenee River" - Mike

"Hike south sister!" - Ian

Focus on the kiddos

"Spend at least a couple days every month camping on a lake with my family. If we need to stay social distanced from others, why not do it on a paddleboard or around a campfire? - Chad

"Take the kids to hunt for Sea-glass at Cannon Beach, teach the kids how to use a slip in slide, sleep on the trampoline, and go to the Drive In Movies!" - Miranda

Celebrate

"My birthday is in January but my wife Lynn and our two children, Gus and Eleanor, all celebrate their birthdays in early July. This year we’re all going to get together for a big (but also small at the same time) birthday and family celebration in July." - Matt

"We're celebrating our 10th wedding anniversary this summer. Although we had hoped to be on a bucket list trip to Scotland, instead we'll head off to our favorite getaway spot in Yachats on the Oregon Coast. Fun fact: We'll stay in the same lodge that my grandparents owned in the 1940s and early 1950s where my father grew up" - Suzanne

Set goals & crush them

"I am planning on continuing to train for some Ironman races that have been rescheduled for the fall." - Mat

"Our vegetable garden growing bigger every day. After we enjoy the fruits of our labor, I'm determined to pickle & preserve whatever is leftover!" - Emily

We hope our summer plans inspired you to make your own list. How are you going to spend the dog days of summer?

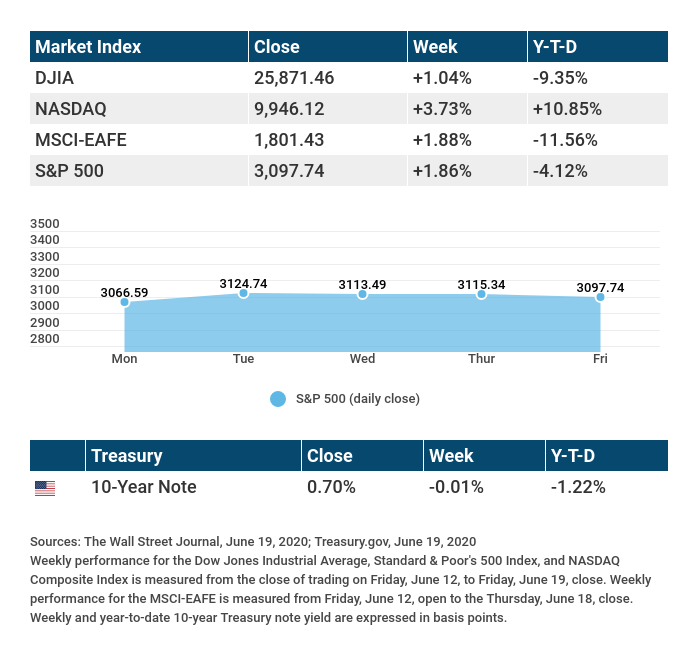

The Week on Wall Street

Stocks moved higher last week on news of more Federal Reserve market support and diminished concerns that new COVID-19 cases might lead to another economic shutdown.

The Dow Jones Industrial Average rose 1.04%, while the Standard & Poor’s 500 gained 1.86%. The Nasdaq Composite Index jumped 3.73% for the week. The MSCI EAFE Index, which tracks developed overseas stock markets, increased 1.88%.[i],[ii],[iii]

Investor Sentiment

News on Monday that the Fed would be expanding its bond-buying program to include the debt of individual companies sparked a sharp jump in stocks. The momentum gained through the week as investors focused on positive economic signals, especially with retail sales. A midweek report of an effective COVID-19 treatment for critically ill patients boosted investor optimism.

Market sentiment also was helped by talk of more fiscal stimulus and a report that China would be moving ahead with agricultural purchases to comply with phase one of the trade deal, easing concerns over growing friction in the U.S.-China relationship.

Mixed Economic Data

Last week’s economic data illustrated the uneven nature of the nation’s nascent economic recovery.

Retail sales, which were up by 17.7% in May, reflected a strong, encouraging rebound in the U.S. consumer. Consumer spending was particularly strong in clothing, furniture, sporting goods, and autos.[iv],[v]

But industrial production (up by only 1.4%) and new housing starts (ahead by just 4.3%) showed tepid rebounds, indicating that recovery has yet to reach all corners of the American economy. Jobless claims posted their best number since mid-March (1.5 million), but remained high by historical standards.[vi],[vii],[viii]

Final Thoughts

Last week saw the flare-up of border tensions in two geopolitical hotspots: North Korea and the disputed border region between China and India. The hope, of course, is that escalation can be avoided through diplomacy, but any heightening in tensions may become a concern for global markets.

THIS WEEK: KEY ECONOMIC DATA

Monday: Existing Home Sales.

Tuesday: New Home Sales.

Thursday: Durable Goods Orders. Gross Domestic Product (GDP). Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, June 19, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Wednesday: KB Home (KBH).

Thursday: Accenture Plc (ACN), Darden Restaurants (DRI).

Source: Zacks, June 19, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

[i] The Wall Street Journal, June 19, 2020

[ii] The Wall Street Journal, June 19, 2020

[iii] The Wall Street Journal, June 19, 2020

[iv] The Wall Street Journal, June 16, 2020

[v] The Wall Street Journal, June 16, 2020

[vi] MarketWatch, June 16, 2020

[vii] CNBC, June 17, 2020

[viii] The Wall Street Journal, June 18, 2020