Rise in Cases Inspires Turbulence

Hello Eagle Wealth Community,

You've heard us say it before but as a reminder, we focus on financial life planning, not just investments! We believe wellness is a balance of health, family, financials, and well-deserved fun. That's why we partner with organizations like the High Desert Museum. As corporate sponsors for 10 years now, one of the perks is a complementary pass* available for you whenever you’d like. Just call Miranda to reserve it and swing by the office for curbside service.

The museum worked hard to prepare for guests and are committed to keeping you safe. Make sure to check out their guidelines here and to reserve your entrance time. Not sure about going indoors at the museum? We get it. The museum also has lots of outdoor exhibits to enjoy in the fresh air. So, go on and have some fun!

Here's more good news — our sponsorship this year is working double duty. The program allowed us to choose a frontline organization to receive a free annual corporate Museum membership for their employees/volunteers. We jumped at the chance and picked Bend's Family Kitchen. These heroes and their volunteers stepped up during these uncertain times and continued to serve over 5,000 meals a month to community members.

Not Central Oregon local? No problem. Check out High Desert Museum from Home for resources and a sneak peek at the exhibits.

* Pass admits 2 adults and 3 children. Please return to EWM after use.

Every week we’re more than impressed with your talent of finding deserving recipients. This week’s story is all about resilience.

“When I read the “Invested in Community” section of EWM’s market update I felt it was a great idea to give back to our community during this tough time.

I chose Studio 126, a salon in Redmond as the business. Tina Perkins the owner, is a hair stylist and also instructs HITT classes at the RAC gym. Since both businesses were closed, she stepped up and started giving online Zoom HITT classes 3 times a week so members of the gym could still get exercise. Tina is very positive, inspirational, and fun. Her salon is now open again, of course following all the covid-19 guidelines and still teaching classes in person at the gym and on Zoom.

Matt let me know my entry was chosen and EWM had purchased a $100.00 gift certificate from Studio 126. I gave the certificate to my good friend. Right from the start she got busy making masks and giving them away to everyone who wanted one. She is always there to offer help to anyone who needs it. When I told her about the certificate she said, “I can’t tell you how excited I am about getting my hair cut by a stylist. It hasn’t been cut since May 2019!”

So, who do you know that could use an uplifting surprise? Maybe your mailman, favorite barista, or home health worker? Our next drawing (open to any region) is Wednesday July 22nd. We can’t wait to hear your story.

The Week on Wall Street

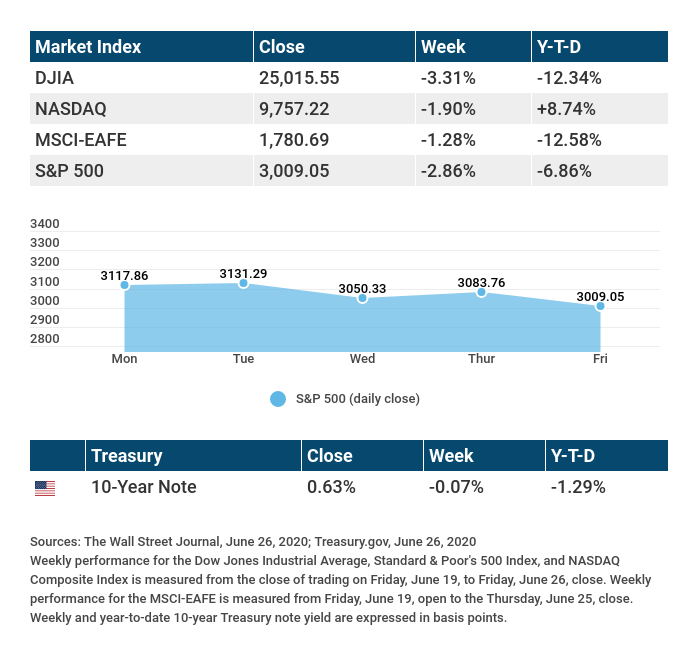

A jump in COVID-19 cases dampened investor enthusiasm last week, sending stock prices lower on worries that rising infections could derail the economic recovery.

The Dow Jones Industrial Average slumped 3.31%, while the Standard & Poor’s 500 retreated 2.86%. The Nasdaq Composite Index lost 1.90% for the week. The MSCI EAFE Index, which tracks developed stock markets overseas, declined 1.28%.[i],[ii],[iii]

A Rocky Week for Stocks

Investors began the week overlooking a jump in COVID-19 cases in some early reopening states, sending stocks higher and powering the NASDAQ Composite to close above 10,000 and establish a new record high on successive days. But the market quickly reversed course as investors reacted to data showing a troubling spike in nationwide COVID-19 cases.[iv]

In Thursday’s trading, stocks opened lower but then rallied late in the day on no apparent news. Stocks resumed their decline on Friday, falling on news that Texas and Florida were rolling back some reopening plans amid rising COVID-19 infections.[v]

COVID-19 Cases

Investor expectations for an economic rebound took a hit last week, following reports of an increase in nationwide COVID-19 cases. The pace of infections had picked up in 33 states, with the seven-day average of new cases higher than the average over the last two weeks.[vi]

While traders understood that reopening and increased testing would lead to an uptick in reported cases, the numbers were a bit unsettling. The week’s action reminded investors that the market remains tightly tethered to COVID-19 developments.

THIS WEEK: KEY ECONOMIC DATA

Wednesday: ADP (Automatic Data Processing) Employment Report. Purchasing Managers Index (PMI) Manufacturing Index. Institute for Supply Management (ISM) Manufacturing Index. Federal Open Market Committee (FOMC) Minutes.

Thursday: Employment Situation Report. Jobless Claims. Factory Orders.

Source: Econoday, June 26, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Micron Technologies (MU).

Tuesday: FedEx Corp. (FDX), Conagra Brands (CAG).

Wednesday: Constellation Brands (STZ), General Mills (GIS).

Source: Zacks, June 26, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

[i] The Wall Street Journal, June 26, 2020

[ii] The Wall Street Journal, June 26, 2020

[iii] The Wall Street Journal, June 26, 2020

[iv] Marketwatch.com, June 23, 2020

[v] FoxBusiness.com, June 26, 2020

[vi] The Wall Street Journal, June 25, 2020