The Retirement Question Everyone Asks

“Will I run out of money when I retire?”

As financial planners, we hear a lot of questions, but this question is by far the most common.

OK, maybe it’s not that question exactly…

When should I claim Social Security?

How much should I contribute to my 401(k)?

Does a Roth conversion make sense for me?

At their foundation, all these questions come down to the same nagging concern: Will I have enough money?

The #1 fear of retirees is outliving their assets – a.k.a., running out of money before they pass away.

It’s an understandable fear. For most people, retirement is when they stop working and, thus, stop earning an income. That’s a foreign concept to anyone after spending decades earning and saving money.

Add onto that the fact that no one can control the future. What will happen tomorrow is largely unknown – let alone 10 years from now.

The bottom line is this: Risk is an inevitable variable when planning for the future in any way, shape, or form. There is no way to completely remove risk from the conversation.

But risk doesn’t have to be scary. In fact, the inevitability of risk makes it all the more predictable.

Retirement income planning is about finding ways to manage risk while planning for your future so you can live your life the way you want without the constant fear of running out of money.

In order to manage the risk, we have to understand it. In short, all risk comes down to two factors, both of which you can control to some extent:

1. A potential bad outcome

The bad outcome we want to avoid in this case is running out of money. You can control the severity of the bad outcome by implementing a few safeguards: maintaining an emergency fund, sticking to your budget, working to stay healthy…

2. The chance that the bad outcome will occur

This is where your financial plan comes in. One of the best defenses against running out of money is a holistic retirement plan that shields you from the worst while preparing you for the best.

Of course, there are other levers you can pull to control the probability of running out of money – tax optimization, long-term care planning, when you claim Social Security (just to name a few) – and if you have a plan with Eagle Wealth, we’re already working on your behalf in all of these areas.

So next time that nagging voice speaks up in the back of your mind, instead of letting it keep you up at night, give our office a call. We’d be happy to review your plan with you.

Until next week,

Your Eagle Wealth Team

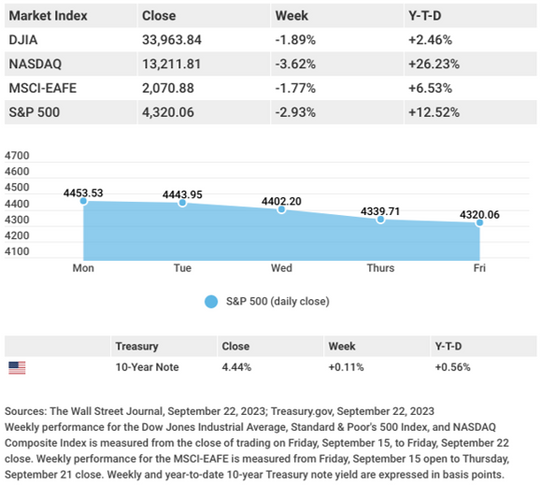

The Week on Wall Street

Rising bond yields and fears of a government shutdown hammered stocks last week, with technology shares bearing the brunt of the retreat.

The Dow Jones Industrial Average lost 1.89%, while the Standard & Poor’s 500 dropped 2.93%. The Nasdaq Composite index tumbled 3.62% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, fell 1.77%.1,2,3

Stocks Sell Off

Investor sentiment took a decidedly negative turn last week when investors were caught off-guard by the Fed signaling another potential rate hike this year, upending hopes that the Fed might finish its current rate-hike cycle.

Stocks declined sharply following the Federal Open Market Committee (FOMC) announcement and continued to fall the following day as bond yields spiked. The 10-year Treasury yield hit 4.48% on Thursday, touching its highest point in more than 15 years.4

Stocks also reacted to news that the House of Representatives went into recess on Thursday, increasing the prospect of a government shutdown. The sell-off cooled on Friday, adding only incrementally to the week’s accumulated losses.

Fed Signals Rate Hike

As expected, the Fed held interest rates steady but surprised many investors by signaling another rate hike before year-end and suggesting that rates may need to remain high through 2024. In his post-announcement press conference, Fed Chair Powell remarked the inflation battle would continue, and upcoming economic data would inform the FOMC’s future rate hike decision.

In their economic projections, 12 of 19 Fed officials expect to raise rates once more this year. (The FOMC meets again on October 31-November 1, and in December.) The Fed also lowered their unemployment projection from their June estimate and revised their projection for annual core inflation to 3.7% in the fourth quarter, down from June’s 3.9% forecast.5

Any companies mentioned are for informational purposes only, and this should not be considered a solicitation for the purchase or sale of their securities. Any investment should be consistent with your objectives, time frame, and risk tolerance

Advisory Services offered through My Legacy Advisors, LLC dba Eagle Wealth Management, a registered investment advisor. Confidential Information: This message and any attachments contain information from Eagle Wealth Management, which may be confidential and/or privileged and is intended for use only by the addressee(s) named on this transmission. If you are not the intended recipient, or the employee or agent responsible for delivering the message to the intended recipient, you are notified that any review, copying, distribution or use of this transmission is strictly prohibited. If you have received this transmission in error, please (i) notify the sender immediately by e-mail or by telephone and (ii) destroy all copies of this message.

1. The Wall Street Journal, September 22, 2023

2. The Wall Street Journal, September 22, 2023

3. The Wall Street Journal, September 22, 2023

4. CNBC, September 21, 2023

5. The Wall Street Journal, September 23, 2023

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2023 FMG Suite.