More Coronavirus Volatility

The Week on Wall Street

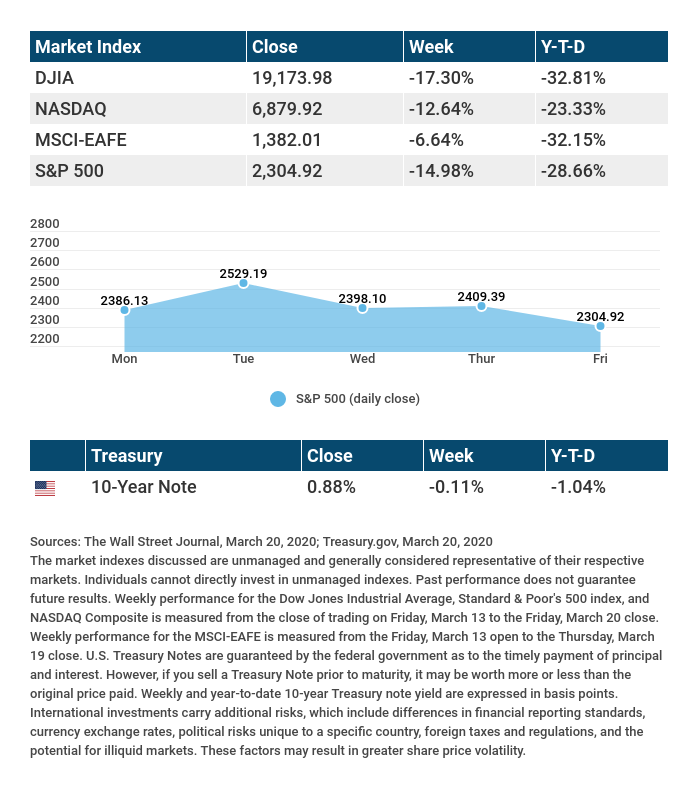

The stock market suffered through another volatile week as it wrestled with the health and economic fallout of the domestic spread of the coronavirus. Swift and decisive actions by the Federal Reserve and policy responses from the federal government did not keep stocks from recording losses for the week.

The Dow Jones Industrial Average slumped 17.3%, while the Standard & Poor 500 lost 14.98%. The Nasdaq Composite index declined 12.64% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, fell 6.64%.[i],[ii],[iii]

Stocks Slide Further

The stock market continued its retreat amid fears of a darkening economic impact from the coronavirus pandemic. Despite a Sunday night announcement by the Federal Reserve that it was cutting its benchmark interest rate by 100 basis points to nearly zero and taking steps to increase market liquidity, stocks opened the week sharply lower, setting the stage for another difficult week for investors.[iv]

Progress was reported on coronavirus testing capacity and on the efforts to combat the infection. At the same time, Washington, D.C., advanced legislation to provide financial assistance to unemployed workers and affected businesses. Neither did much to help investor anxieties, however. Stocks slid in the closing hours of the trading week, leaving stock indices near their lows of the week.[v]

Central Bankers Go Big

The response of global central bankers to mitigate the economic impact of the coronavirus has been broad ranging. In addition to its 100 basis point cut in the federal funds rate, the Federal Reserve also took actions to provide additional credit access to banks, committed to buy at least $700 billion in Treasury and mortgage bonds, and set up a new lending facility to backstop money market funds.[vi]

The European Central Bank also announced an $800 billion-plus bond buying program to support member economies. The Bank of England cut its benchmark lending rate to 0.1% and pledged to buy over $200 billion in government and investment grade corporate bonds, while the Bank of Japan said that it would double its purchases of stocks and increase loans to businesses.[vii],[viii],[ix]

Final Thought

Investors are struggling with answers to two unknowns: the trajectory of the coronavirus spread and its economic cost. With coronavirus testing beginning to ramp up, these numbers may begin drawing a firmer picture of the growth of coronavirus infections in the U.S. Economic indicators, such as jobless claims for unemployment insurance and the Index of Leading Economic Indicators, may provide clues regarding the economy.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: New Home Sales.

Wednesday: Durable Goods Orders.

Thursday: 4th-quarter GDP (Gross Domestic Product) Report. Jobless Claims for Unemployment.

Friday: Consumer Sentiment.

Source: Econoday, March 20, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Nike (NKE), Carnival Corp. (CCL)

Wednesday: Micron Technologies (MU)

Thursday: Lululemon (LULU), KB Home (KBH)

Source: Zacks, March 20, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

[i] The Wall Street Journal, March 20, 2020

[ii] The Wall Street Journal, March 20, 2020

[iii] The Wall Street Journal, March 20, 2020

[iv] CNBC.com, March 15, 2020

[v] CNBC.com, March 20, 2020

[vi] The Wall Street Journal, March 19, 2020

[vii] CNBC.com, March 19, 2020

[viii] Pension & Investments, March 19, 2020

[ix] Financial Times, March 16, 2020