Jobs Down, Stocks Up

Hello Eagle Wealth Community,

Last week we held our first live economic webinar with City National Rochdale and received a great deal of positive feedback from those who participated. These are unprecedented times and our goal is to help you sort through the often-overwhelming amount of information out there, and to put the focus on what really matters for your financial plan. To that end, we’re planning more webinars for our EWM community. Watch your inbox in the weeks to come for more information and webinar invitations.

As always, we’re here to help and to answer any questions you have. Stay safe and stay healthy!

Your Eagle Wealth Team

CNR Webinar Recording

Missed last week’s economic webinar with Chad, Garrett and Robert? No worries. Watch the webinar recording or view the slides here whenever you want.

Emily and Tyson were quite disappointed when their wedding in Northern California was postponed from May until hopefully the fall. Their wedding may be cancelled for now, but their love is not and they’re making the best of their time at home!

Emily is busy working outside building the vegetable garden of their dreams. Now that they have some extra time before the wedding, they're growing their own succulents for table centerpieces. With this slower pace of life, they’re recognizing the delightful simplicity of planting seeds and watching them grow.

Stuck inside? No yard? No problem. Here are some tips for indoor gardening.

The Week on Wall Street

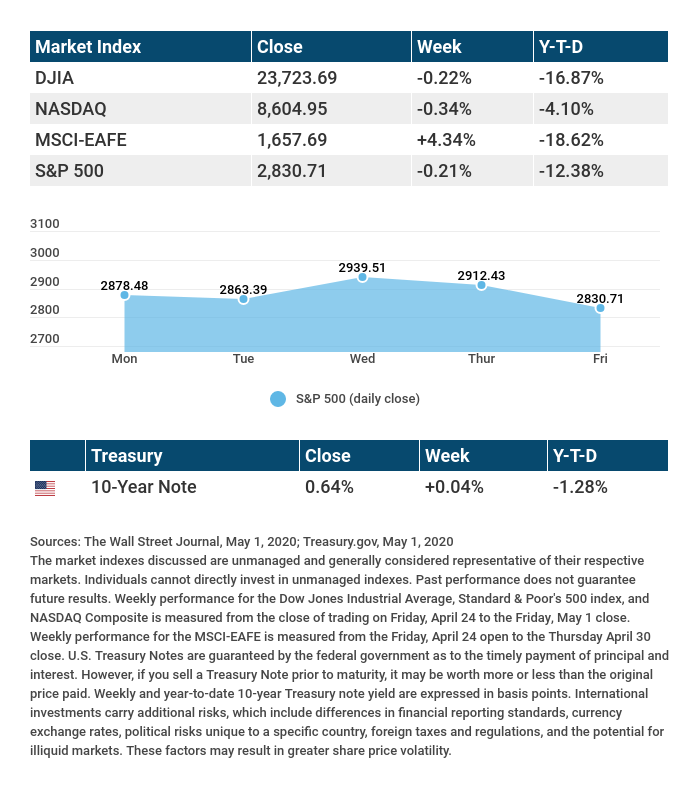

Despite a historic downturn in employment, stocks managed to climb higher last week as investors were emboldened by the pace of economic re-openings, both here and abroad.

The Dow Jones Industrial Average gained 2.56%, while the Standard & Poor’s 500 advanced 3.50%. The Nasdaq Composite Index jumped 6.00% for the week. The MSCI EAFE Index, which tracks developed overseas stock markets, slipped 1.09%.[i],[ii],[iii]

Tech Stocks Power NASDAQ

Last week’s trading was driven by a crosscurrent of emotions — worries about weak corporate earnings pace of business re-openings as well as optimism over the pickup in economic activity and progress on developing a vaccine.

Stocks posted back-to-back daily gains to end the week despite troubling employment data. Perhaps the headline of the week was that the technology-heavy NASDAQ Composite Index moved into positive territory year-to-date.[iv],[v]

A “Silver Lining” in the Jobs Report?

Last week brought into stark focus the number of jobs lost since the start of the economic shutdown. Since mid-March, unemployment insurance claims have reached 33.5 million. The pace of newly unemployed has slowed down, however, with recent weeks at about half the rate at the peak in late March.[vi],[vii]

April’s employment report, released on Friday, saw a spike to 14.7% in the unemployment rate. As severe as these numbers may be, 88% of April’s newly unemployed characterized their job loss as temporary rather than permanent, as opposed to 47% of the newly unemployed in March who said their job loss was temporary.[viii],[ix]

THIS WEEK: KEY ECONOMIC DATA

Tuesday: Consumer Price Index.

Thursday: Jobless Claims.

Friday: Retail Sales; Industrial Production.

Source: Econoday, May 8, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Under Armour (UAA), Simon Property (SPG), Caesars Entertainment (CZR).

Wednesday: Cisco Systems (CSCO).

Source: Zacks, May 8, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

[i] The Wall Street Journal, May 8, 2020

[ii] The Wall Street Journal, May 8, 2020

[iii] The Wall Street Journal, May 8, 2020

[iv] The Wall Street Journal, May 8, 2020

[v] The Wall Street Journal, May 8, 2020

[vi] CNBC, May 6, 2020

[vii] CNBC, May 6, 2020

[viii] The Wall Street Journal, May 8, 2020

[ix] The Wall Street Journal, May 8, 2020