Concerns About Oil

The Week on Wall Street

Stocks descended from record highs Friday, as traders reacted to a U.S. drone strike that killed Iran’s top military officer. Oil prices rose more than 3% following the breaking news.[i]

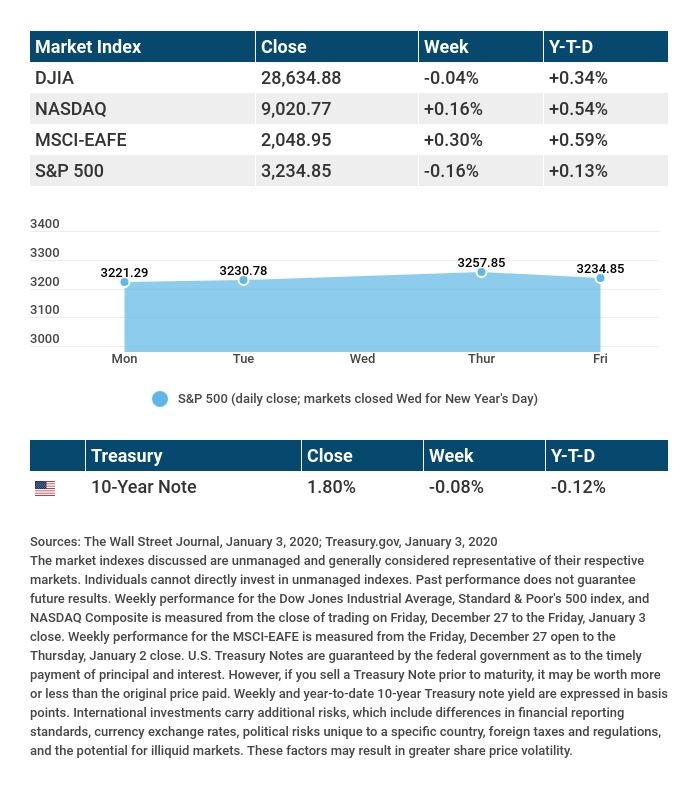

Wall Street benchmarks ended up having a sideways week, shortened by the New Year’s Day holiday. The Dow Jones Industrial Average lost 0.04% across four trading sessions; the S&P 500, 0.16%. In contrast, the Nasdaq Composite rose 0.16%. The MSCI EAFE index, benchmarking developed overseas stock markets, added 0.30%.[ii],[iii]

Oil Takes Center Stage

WTI crude oil settled at $63.07 a barrel on the New York Mercantile Exchange Friday, down from an intraday peak of $64.09 (which was its highest price since April).

The commodity rallied Friday, as energy traders considered the possibility of supply disruptions in the Middle East in retaliation for last week’s U.S. air strike.[iv]

Manufacturing Activity Declines

At the start of each month, economists watch the Institute for Supply Management’s Purchasing Managers Index for the factory sector, which is considered a key barometer of U.S. manufacturing health.

Last week, ISM announced a December reading of 47.2 for this index, the poorest in more than ten years. A reading below 50 indicates manufacturing activity is contracting rather than expanding.[v]

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: The Institute for Supply Management presents its December Non-Manufacturing Purchasing Managers Index, gauging the pace of activity in the U.S. service sector.

Wednesday: Payroll processor ADP releases its December national private-sector employment report.

Friday: The December jobs report from the Department of Labor.

Source: MarketWatch, January 3, 2020

The MarketWatch economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Wednesday: Constellation Brands (STZ), Lennar (LEN), Walgreens Boots Alliance (WBA)

Friday: Infosys (INFY)

Source: Zacks, January 3, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.